When venturing into the world of options trading, particularly cash-secured put writing, one crucial factor that shapes an investor’s strategy is the nominal share price of stocks. These prices are not indicative of a company’s underlying value but play a pivotal role in determining the capital requirement and risk level for options traders. Grouping stocks by their nominal share prices offers a structured approach to select potential investments based on budget constraints and investment goals.

The Significance of Share Price Strata

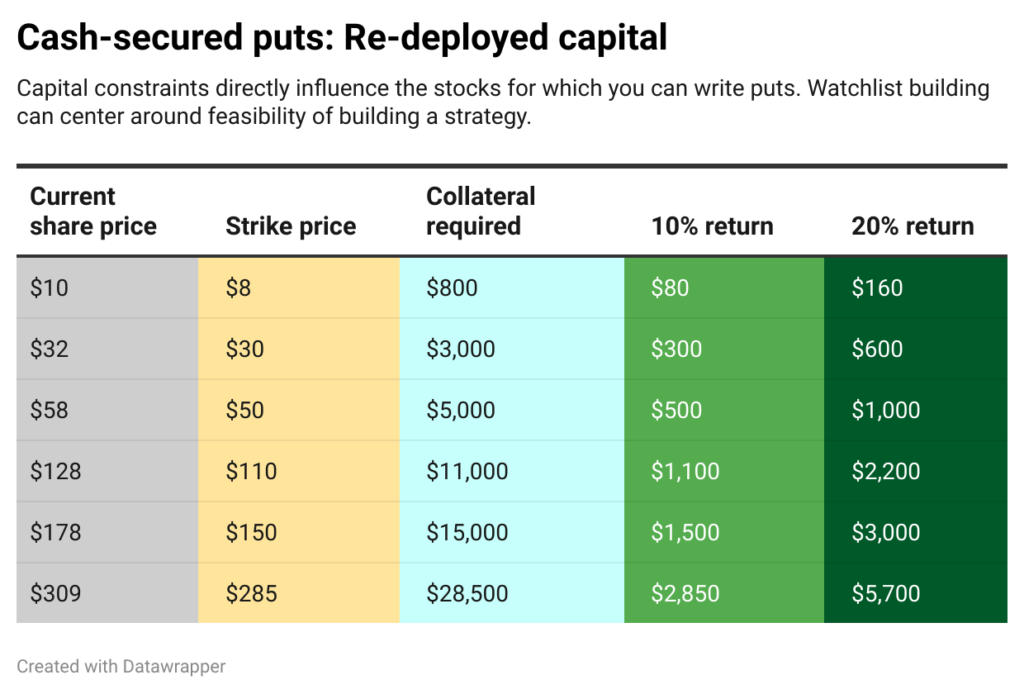

Stocks can be broadly categorized into various price ranges: penny stocks (under $5), mid-range ($5 to $50), and high-value stocks (above $50). Each group may represent a different level of volatility, liquidity, and, most importantly for options traders, a different capital engagement level. You can splice these groupings to meet your needs, but the sample chart below helps demonstrate why this may be important:

Credit: Me

It is important to note here that these scenarios are made up. The returns associated with these samples may not directly correlate to what you’ll find in the market. For example, as the difference between the current share price and strike price goes up, the rate of return will be influenced directly. In the above, the $32 for $30 cash-secured put may be riskier based on the relatively low share price decline required for share assignment. However, it may be a low volatility underlying stock, the contract may be expiring soon, or maybe it’s overpriced and there are better deals in the market.

Nominal share price is not directly correlated to underlying company value. However, we can follow these generalized thoughts on nominal share price groupings below:

Penny Stocks (<$5): While attractive due to their low entry price, these stocks often come with higher volatility and lower liquidity. Options trading in this group might offer lower capital requirements but at a higher risk and potential for significant percentage moves.

Mid-Range Stocks ($5 to $50): This group is where many retail investors find a sweet spot for options trading. The share prices are high enough to ensure a certain level of company stability and liquidity but low enough to keep capital requirements within a reasonable range. This range is ideal for beginner to intermediate traders looking to execute cash-secured puts without tying up large sums of money.

High-Value Stocks (>$50): Trading options in this category requires a more significant capital commitment but is often associated with established companies that have lower volatility. For investors with more capital, this range offers the opportunity to write puts on premium stocks, potentially earning higher premiums while facing lower percentage volatility.

Starting with Cash-Secured Put Writing

I view options writing as an alternative income generator. A means of capitalizing your idle cash. Below I’ll analyze traditional real estate investment versus cash-secured put writing:

Scenario #1: Real Estate investment option

Assumptions and definitions:

You are purchasing a $250k, single-family home with 20% down, or ~$50k up front.

- Mortgage Payment: The monthly payment will be on the remaining $200,000 mortgage. This will depend on the interest rate and the term of the loan.

- Rental Income: The monthly income generated from renting out the property.

- Operating Expenses: These include property taxes, insurance, maintenance, and property management fees, among others.

- Vacancy Rate: The percentage of the year the property might be vacant and not generating rental income.

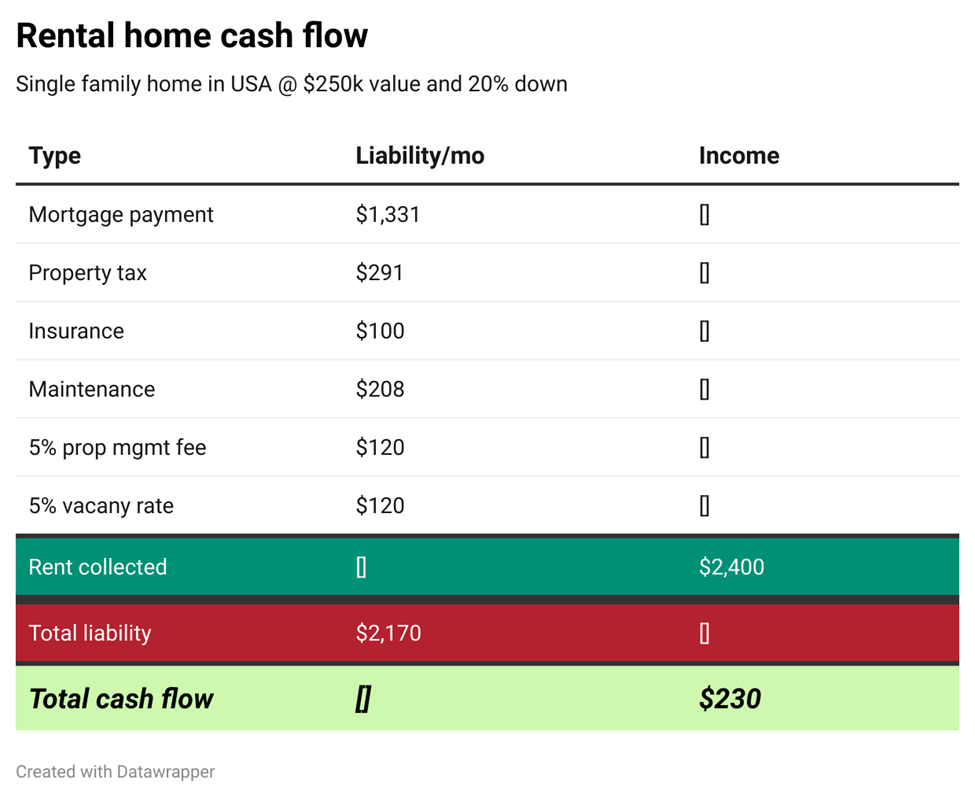

Let’s illustrate a basic model:

- Interest Rate: 7%

- Loan Term: 30 years

- Monthly Rental Income: $2,400

- Annual Property Taxes: $3,500

- Annual Insurance: $1,200

- Maintenance and Other Expenses: $2,500 (1% of property value)

- Property Management Fees: 5% of rental income.

- Vacancy Rate: 5% of the year (about 18 days).

Credit: Me

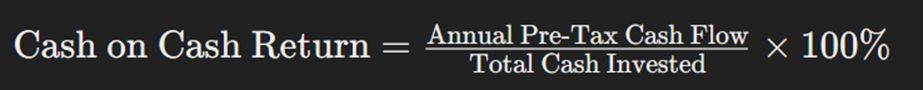

Total cash flow here is approximately $2,760 per year. Assuming a 3% rate of appreciation, the home would gain around $8k per year in equity. However, the cash-on-cash return calculation is below:

The annual cash on cash return = $2,760 / $50,000 * 100% = 5.52%

This scenario does not account for closing costs or renovation upgrades required for tenant move-in. The property management fee is also modest. But overall, a realistic cash on cash return may look like 5.5% before we incorporate taxes, appreciation, or other external value factors.

Scenario #2: Cash-secured put writing for Amgen

I have not yet reviewed Amgen, but they are a leading global pharma company that specializes in discovering, developing, manufacturing, and delivering innovative human therapeutics. The company earns revenue primarily through the sale of its biologic medications across various therapeutic areas, including oncology, nephrology, cardiovascular, and inflammatory diseases. Costs in all these therapeutic areas are growing. One of Amgen’s top-selling drugs is Enbrel, used for treating several chronic conditions such as rheumatoid arthritis and plaque psoriasis. Enbrel’s patent doesn’t expire until the end of this decade. Amgen’s business model focuses on leveraging cutting-edge science and biotechnology to address diseases with a high unmet medical need. The company’s financial success is driven by its strong portfolio of patented biologic drugs, which are critical in managing complex diseases.

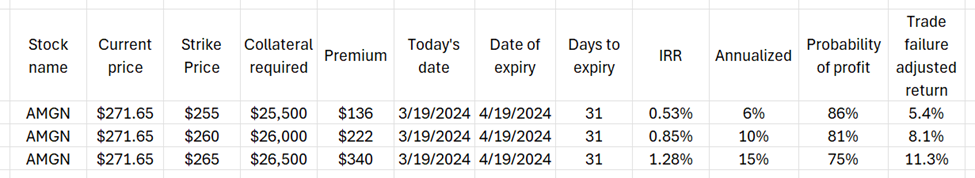

I pulled options data from 3/19 @ 2pm to give a sense of what returns might look like if a perpetual trading strategy was built around Amgen.

Credit: Me

In these scenarios, the annualized returns would be calculated from the trade failure adjusted return, one of my metrics that overlays probability of profit onto an existing strategy. This would be in a relatively predictable market context.

These trades could be performed approximately 11 times in one calendar year (11.77) based on the 31 days to expiry value.

Credit: Me

With $51,000 in capital, perpetually selling the $255 strike price contract would net: $2,992/yr

With $52,000 in capital, selling the $260 strike price contract would net: $4,884/yr

With $53,000 in capital, selling the $265 strike price contract would net: $7,480/yr

In the lowest risk setup, we are still netting a greater cash flow than the rental property scenario. At the end of this cycle, you will preserve your ~$51-53k of starting capital! We also get added liquidity because the US markets are very simple to enter and exit. If you need your money, you can close your trade at the current market price of the contract to release your collateral and move forward with your next endeavor. Though homes are not lasting long on the market, there is no debate that options trading offers more liquidity than outright rental property ownership

There is an additional margin of safety with trading a company like Amgen that struts a BBB credit rating. The recent Fitch rating stated: “Amgen’s ‘BBB’/Stable rating is competitively positioned relative to peers in terms of scale, breadth, depth, geographic reach and patent risk”. It’s also a dividend payer, with a current fwd yield of 3.31%. If shares are assigned, you’ll get paid to hold. Though only a slight advantage, cash-secured put trade failure, or share assignment, implies that the stock will be owned at a price lower than the current price (if you sell a put that is out of the money). So the fwd yield in the future will technically be even higher than the current yield.

I am confident that the analysis of these two scenarios demonstrate the benefits of selling cash-secured puts as at least as viable of an option to generate income as rental property ownership.

Tips on how to build out your stock grouping:

Selecting Your Nominal Share Price Group

Based on your available capital and risk tolerance, select a share price group that aligns with your trading goals. Start small. Consider factors such as the overall market environment, sector performance, and individual stock fundamentals within your chosen price range.

Identifying Opportunities

Within your selected share price group, look for stocks that exhibit solid fundamentals, including strong balance sheets, growth potential, and favorable industry trends. Utilize technical analysis to identify entry and exit points, focusing on stocks that are perhaps temporarily undervalued. If of course you don’t have time for this, find a trustworthy analyst to identify stocks that have upside.

Managing Risk

- Capital Allocation: Never allocate more than a certain percentage of your total investment capital to any single trade. It’s strange, but we do this in real estate all the time. Individuals will invest a significant amount of their total capital into a home or rental property. Diversifying across different stocks and sectors within your chosen price group can mitigate risk. Index funds and ETFs build baskets with slices of stocks and even exposure to different regions in the world. Stick to what you know or what you believe in.

- Strike Selection: Choose strike prices that offer a good balance between premium received and the desire to own the stock at that price. It’s generally advisable to select strikes at or below your target entry price for the stock.

- Expiration Dates: Shorter-term options (1-3 months out) typically offer higher annualized return potential but require more active management. Longer-term options provide more cushion against market volatility but tie up your capital for extended periods. At least your capital isn’t tied up for 30 years

Conclusion

Getting started with options trading through cash-secured put writing demands a strategic approach to selecting stocks based on their nominal share prices. By categorizing stocks into price-based groups, investors can more effectively align their options trading strategies with their financial goals, risk tolerance, and capital availability. This method not only streamlines the selection process but also fosters a disciplined approach to risk management and capital allocation. If you’re considering the purchase of a rental property in your area, it may be worth re-considering whether options trading may be a better option as part of your wealth-building journey.