In 2014, an early-stage cell therapy legend was born. The following may contain: “supernatural beings, elements of mythology, or explanations of natural phenomena, but they are associated with a particular locality, entity or person and are told as a matter of history.” In this post, I walk through some thoughts on CAR-T therapy, recent developments for Legend Biotech, and then an assessment of a few medium- to intermediate term cash-secured puts, with potential gains mapped.

Legend Biotech, in their words:

The company was the brainchild of visionary scientists who recognized that antibody-based therapeutics could potentially treat disease and possessed the backgrounds in immunology and gene editing to take the leap.

For two years, Legend Biotech, then known as the “Legend Project,” operated in a room the size of a freight elevator, with the goal of creating a cell therapy for multiple myeloma, a hematological cancer that often relapses and can become refractory. The team produced nanobodies for single-domain antibody drugs and ultimately extended the half-life of the nanobodies with proprietary technologies.

In 2015, Legend’s scientists focused on research for chimeric antigen-receptor T-cells (CAR-T) targeting the BCMA protein, making the biotech one of the first companies in the world to engineer CAR-T cells for the BCMA protein. In 2016, investigator-initiated trials began in China.

In 2017, data from the trials were presented at the American Society for Clinical Oncology (ASCO), which led to a partnership with biopharmaceutical company Janssen Biotech, Inc. to co-develop the anti-BCMA CAR-T, ciltacabtagene autoleucel (cilta-cel). Applications seeking approval of cilta-cel for the treatment of patients with RRMM are currently under regulatory review by several health authorities around the world. CARVYKTI™ (ciltacabtagene autoleucel) was approved by the U.S. Food and Drug Administration in February 2022 and received conditional marketing approval from the European Medicines Agency in May 2022.

Today Legend Biotech is a global, commercial-stage company driven by a passion for patients. We continue to build our pipeline of cell therapy platforms, which includes CAR-T, CAR-NK, CAR-γδ T and non-gene-editing CAR technologies.

The Legend

Legend Biotech revenues are directly correlated with this collaborative agreement. It’s a commercial partnership with Janssen, or Johnson & Johnson Innovative Medicines. It’s interesting to see unique contracts as I learn more about commercialization. Let’s view this as Carvykti cost- and profit-sharing. The global agreement “specifies a 50-50 cost and profit-sharing agreement in all markets, excluding Greater China, where the split is 70% for Legend and 30 percent for Janssen.”

CAR-T therapy is growing sharply in prominence for blood cancers. An Allied Market Research report suggests the space is anticipated to generate $35.9 billion by 2032, witnessing a CAGR of 28.5% from 2023 to 2032.

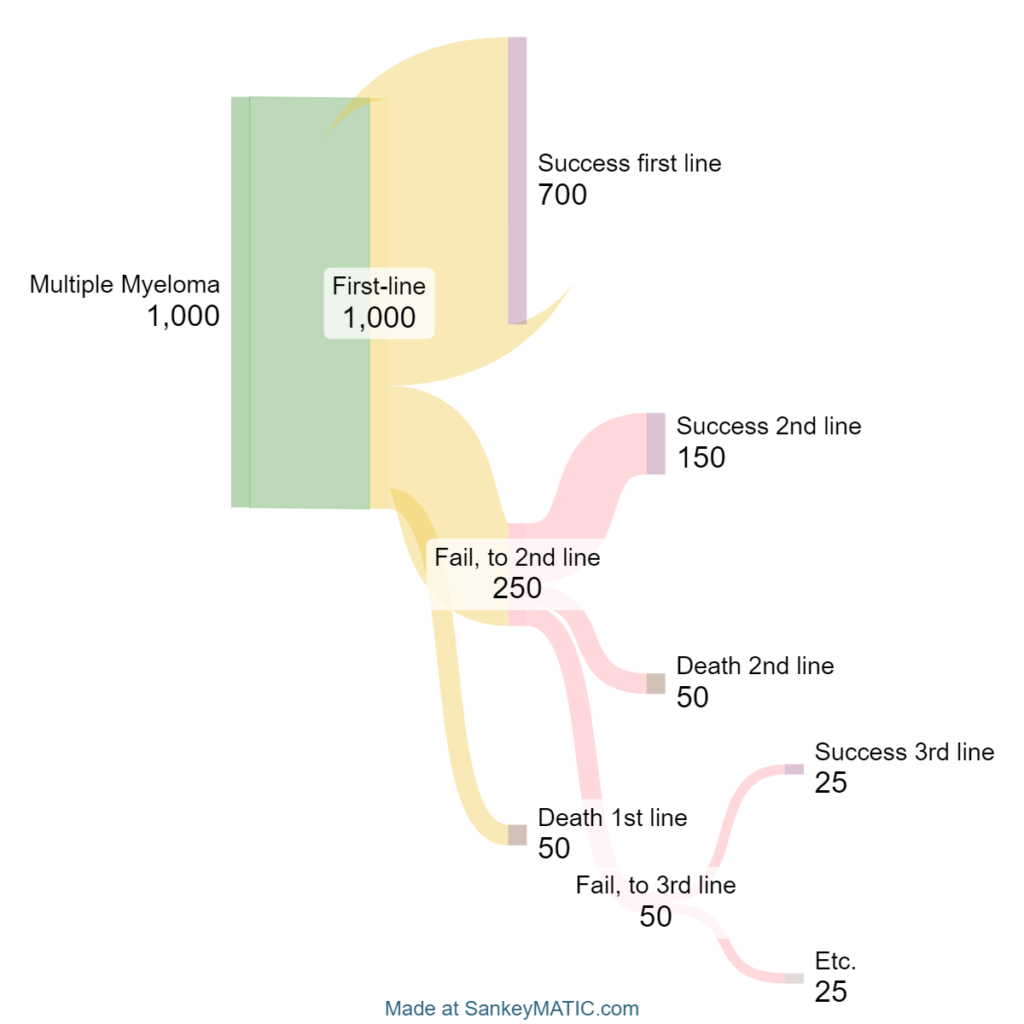

Multiple Myeloma is rather prevalent too, at an estimated 35k new cases projected for 2024. A 2020 epidemiology study published in Future Oncology found that prevalence in the USA in 2020 was 144,922, projected to increase to 162,339 in 2025. Corresponding unique multiple myeloma patients by line of therapy in 2020 were: 53,176 (1st; minimum–maximum: 47,304–59,212), 19,407 (2nd; 15,935–23,273), 6,481 (3rd; 5143–8877), 1649 (4th; 1146–2667) and 426 (5th; 217–876).

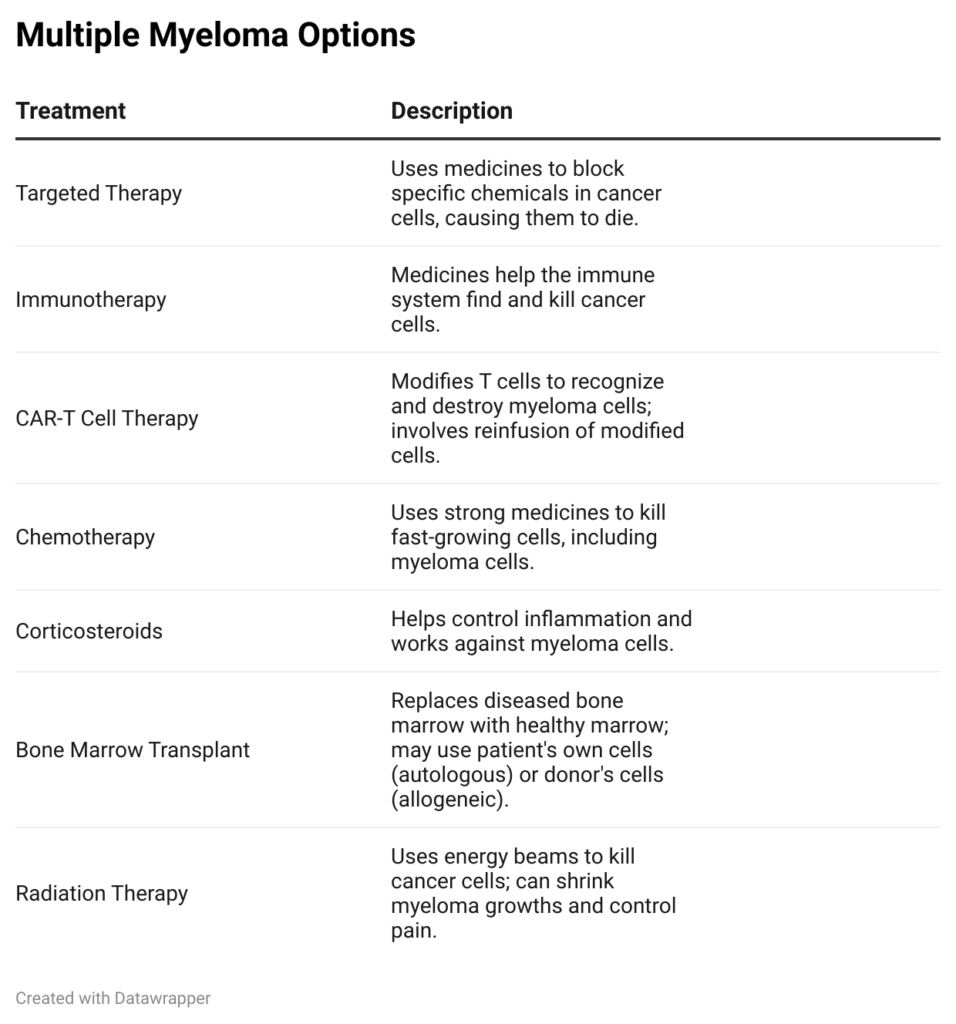

Here is a chart of treatment modalities available for multiple myeloma.

Credit: Me

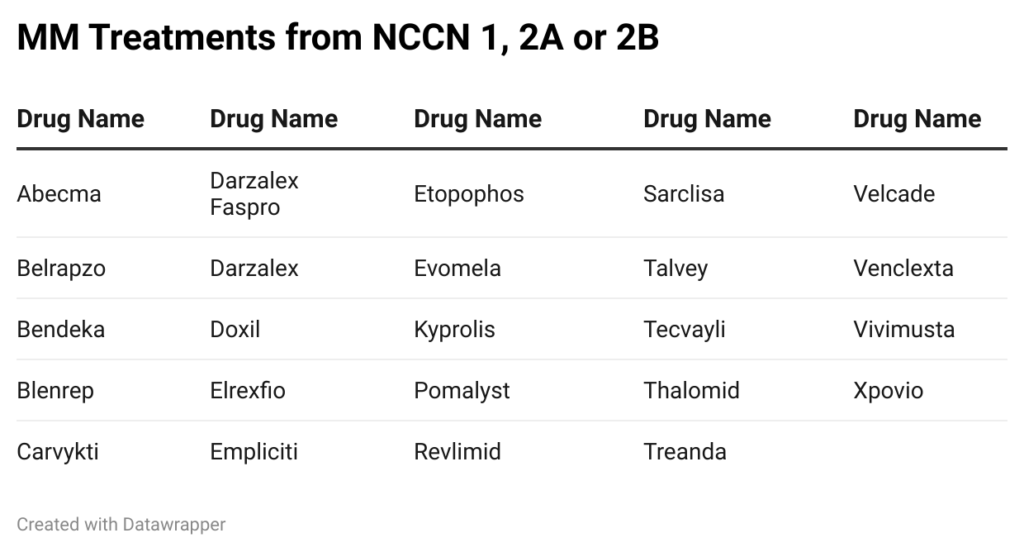

Carvykti is a fifth-line option to treat multiple myeloma, however there are plenty of chemotherapy options available on the market today.

Credit: NCCN compendia

These products range from first to fith-line. Long-standing chemo options like cisplatin and cyclophosphamide aren’t included. Place in therapy is crucial for prescription and utilization. Think about the typical evidence progression over time. Clinicians will use the standard of care for typical patient presentations. To break into the market, pharma companies must work their way up the preferencing chain. If the best option doesn’t work, you move on to the next one. Most clinical trial eligible patients for new entrants will have already tried one, two, three or more therapies in the hopes of achieving remission or progression-free survival. Below is a sample progression to accentuate the impact on utilization.

Credit: Me

Carvykti is one of six options in the CAR-T space. Yet, it’s one of only two CAR-T options approved to treat multiple myeloma. Chart below with some condensed financial/clinical data:

Credit: Me

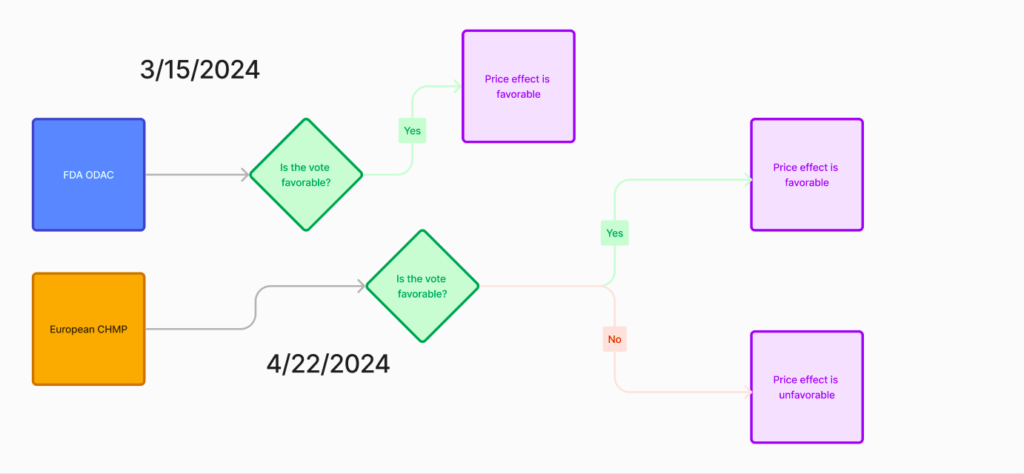

Of note recently is the significant data published in Legend’s CARTITUDE-4 study. I’ll defer to the advisory committees in the chart below, but there is a significant potential move for Carvykti in the line-of-therapy realm. Governing bodies like the Federal Drug Administration and European Medicines Agency play a significant role in how biologics are used in clinical practice.

Credit: Me

Legend Biotech recently submitted an sBLA (supplemental biologics license application) for Carvykti, supported by data in the CARTITUDE-4 study. This request sought permission to amend the existing language within the prescribing information, which guides the use of the biologic product. Here is Carvykti’s foray into 2nd-line therapy, formerly fifth.

The FDA’s Oncologic Drugs Advisory Committee (ODAC) met this Friday, Mar 15th and unanimously decided that Carvykti’s indication label can be updated to the following:

Indication: CARVYKTI is a B-cell maturation antigen (BCMA)-directed genetically modified autologous T cell immunotherapy indicated for the treatment of adult patients with relapsed or refractory multiple myeloma who have received at least 1 prior line of therapy, including a proteasome inhibitor and an immunomodulatory agent, and are refractory to lenalidomide

Here is the clinical determination question:

Is the risk-benefit assessment for ciltacabtagene-autoleucel for the proposed indication, favorable?

The committee results were 11 votes to 0 votes in favor of yes!

Moving up the preferencing tree will directly impact the # of patients treated with Carvykti. As in the sample progression earlier, you can see how a company’s total addressable patient population (TAPP) increases when the drug is moved up in the treatment algorithm. It was formerly buried as a fifth-line option. The line of therapy data cited earlier suggested that 90% of patients being treated in 2020 were on either first-line or second-line therapy. I won’t make direct forecasts, but I will claim that Carvykti is set to grow if the CHMP ruling is favorable in April.

Options writing

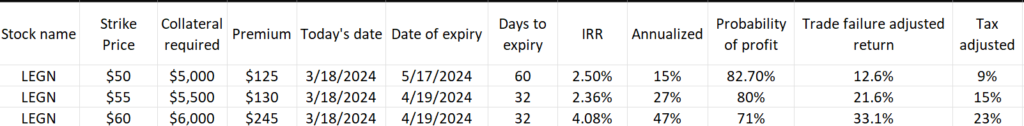

We’ve outlined some of the upside and catalysts for Legend Biotech. My outlook is mostly bullish. If your entry price is lower, then set your strike lower. The best time to write is always right now. The market showed some downward action on the 3/15 news release for the CARTITUDE-4 study, but I wouldn’t expect much volatility before 4/19 unless it’s supplied by the broader market.

Below is a potential returns chart with three separate strike prices and two unique dates of expiry

Credit: Me

I like to give the annualized returns projection a haircut by multiplying the probability of profit value with the perpetually re-deployed returns of an IRR. This is “failure-adjusted” in a sense. Significant stock decline is increasingly less likely as the probability of profit approaches 1. However, we have to understand that not every trade will result in premium collection from a contract that expires worthless. There will be trades that expire just in-the-money. Also, the annualized returns will likely never be directly realized in a given trading time frame. Tomorrow, next week or next month, the market price for these contracts and the next re-deployment cycle will change the rate of returns.

When deciding on an entry point, a few opinions wouldn’t hurt. Leverage different resources to build out a full picture of your “long” position price point. Ultimately, if you’re writing a put option and this is your only exposure, then your sentiment is bullish long-term. I like the $55 strike here with Legend, netting a cool 2.36% return for about a 1-month holding period. Tax adjusted, @ a 30% tax rate, we’re still seeing this as an annualized trade return of about 15%. This is more napkin math, I’m still researching how to more accurately model returns in this way. The risk-reward seems favorable. The current trade price sits at $64.02, so the $55 strike would imply a 14.08% decline is required to trigger share assignment. And if you do get shares assigned, you now have exposure to a novel tech owner with a leading product in a growing space. Also, sharp price movement is less likely with major catalysts absent during the trade window. No earnings upcoming, and the CHMP news will still be unreleased at time of expiry. Get writing and start collecting!

Summary

The CAR-T space is a prime example of how drug delivery is evolving. We can now administer smart therapies that will modify internal human machinery to fight against malicious cells that directly cause functional decline. Carvykti has the potential to make a big jump in preferencing in its two largest markets, USA and Europe. Though Legend Biotech shares about half of their profit with Janssen (a Johnson & Johnson subsidiary), the TAPP is always growing and Carvykti is positioned with the potential to treat more patients earlier in the care journey. With $5000 in capital, you can get started in netting returns on your terms by writing options. If your prediction fails (which inevitably does, uncommonly), then you’ll become a shareholder of stock that can grow along with rising CAR-T prominence. You can make the market.