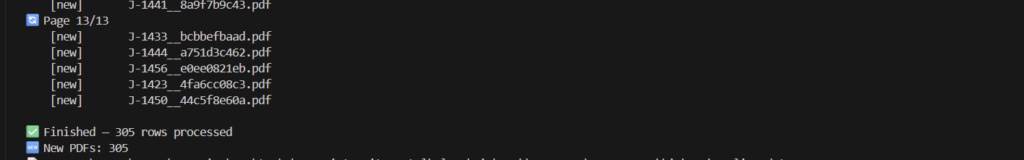

Highmark maintains 305 commercial drug prior authorization policies.

- 6 were posted in the last 7 days

- 15 in the last 30 days

- 88 in the last 60 days

That’s nearly 30% of their PA policies re-posted in the last two months.

Do you know which ones affect your formulary?

What Changed This Month

Highmark posted 14 policies in January 2026 alone:

| Date | Policy | What It Covers |

|---|---|---|

| Jan 15 | Chronic Inflammatory Diseases | Humira, biosimilars, JAK inhibitors |

| Jan 15 | Chronic Inflammatory (National Select) | Same class, different formulary |

| Jan 14 | Anti-Obesity (Enhanced) | GLP-1 agonists (Wegovy, Zepbound) |

| Jan 14 | Market Watch Programs (DE, NY, PA, WV) | State-specific monitoring |

| Jan 12 | Step Therapy Exceptions | Appeals pathway updates |

| Jan 6 | Experimental/Investigational Products | Coverage exclusions |

| Jan 1 | Entresto, Savella, Glatiramer, Dry Eye, BCR-ABL | Five drug-specific policy refreshes |

The Chronic Inflammatory Diseases policy alone is 816 KB—nearly 4x the average policy size. That’s complexity: multiple drugs, multiple pathways, multiple ways to get denied.

The Pattern

Highmark’s update velocity isn’t random:

- October 2025: 73 policies (bulk update cycle)

- December 2025: 74 policies (year-end refresh)

- July 2025: 48 policies (mid-year adjustment)

Payers batch policy updates around new drug approvals, annual formulary reviews, regulatory changes, and contract renegotiations. If you’re not monitoring these cycles, you’re reacting instead of preparing.

Why This Matters

Every policy update is a potential coverage change. A tightened step therapy requirement. A new documentation burden. A compressed or elongated approval duration.

I’m building infrastructure to track change, such as:

- Automated crawling across commercial plans

- Version tracking with cryptographic hashes (I can prove what changed and when)

- Structured extraction of approval criteria, step therapy, exclusions and denial logic

- Delta alerts when policies shift (meaningfully, and tuned to the needs of the client)

This is what “manufacturing alertness” looks like.

Most employers and benefits consultants operate at an information disadvantage with their PBMs. They can’t easily compare coverage across plans, can’t track what changed, and can’t credibly threaten to switch because they don’t know if the alternatives are better or worse. That asymmetry keeps them locked in. This infrastructure is designed to change that — to make exit legible and voice credible, whether mid-cycle or during active contracting.

What’s Next

I’m expanding this to a market sample basket:

- Medica

- UnitedHealthcare

- Cigna

- BCBS Illinois

And focusing on therapeutic areas where the stakes are highest, including, but not limited to (and eventually all policies):

- Atopic dermatitis (Many policies and new entrants across multiple IL-4/IL-13 inhibitors and JAK inhibitors)

- Chronic migraine (Still a busy class)

- Select rare diseases (enzyme replacement, substrate reduction, congenital disease, orphan drugs)

If you’re a benefits consultant, hub, specialty pharmacy, or pharma market access team—this is the kind of intelligence that changes how you operate, and I’m adding on the layers to make it a bonafide data product that saves time and money.

Want early access? DM me or comment below.