Introduction

Spread pricing has become a significant pain point in pharmacy benefit management. Under this model, the pharmacy benefit manager (PBM) charges payers a higher price for a drug than what it reimburses to the pharmacy—and pockets the difference. This hidden margin can lead to elevated costs for health plans and, ultimately, higher premiums or out-of-pocket expenses for patients. Not to mention the retail pharmacies getting duped on price too. The lack of transparency undermines trust in the entire system, leaving plan sponsors unsure if they are truly getting the best deals on prescription drugs.

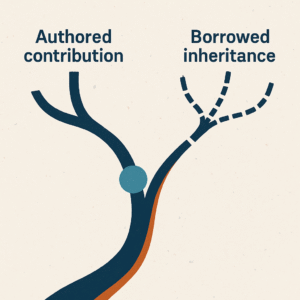

Why Admin Fees Align Incentives

In contrast to spread pricing, an admin fee model charges a flat per-member-per-month (PMPM) fee or a predictable administrative rate. Because the PBM or pharmacy services administrator is no longer incentivized to profit from each prescription, payers can feel more confident that the pricing is transparent and competitive. Though this may not be certain, aligning incentives this way encourages honest dealings with pharmacies, fosters better negotiations with drug manufacturers, and drives plan sponsors to explore cost-saving strategies without hidden markups eroding potential gains.

Designing a Sustainable Admin Fee Structure

When transitioning to an admin fee arrangement, several factors should guide the pricing model:

- Plan Size: Larger groups often benefit from volume discounts, so the admin fee can be scaled down as membership grows.

- Drug Mix: Specialty drugs and high-cost therapies typically require more intensive clinical management, so a tiered fee structure may be appropriate. This could also be a channel mix as well, with pre-specified generic and brand % of spend or Rx ratios being guaranteed at a specific rate.

- Levels of Service: Some sponsors may only need basic formulary management, while others want comprehensive services such as utilization reviews, chronic disease management, or real-time reporting tools. Each added layer of service can be reflected in a predictable fee rather than hidden charges.

Ensuring Transparency and Accountability

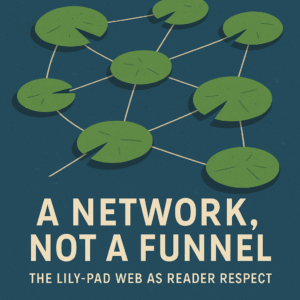

A hallmark of an effective admin fee model is real-time data visibility. Payers should have access to dashboards that show claim-level costs, rebates, and patient outcomes. Regular audits and open disclosure of any revenue streams—such as manufacturer rebates—further ensure that the PBM isn’t profiting in ways that undermine the original intent of the flat fee. This level of transparency can promote stronger partnerships and trust among more (likely not all!) stakeholders.

Success Stories and Ongoing Challenges

Early adopters of transparent admin fee models have reported cost savings and improved plan satisfaction. Pilot programs demonstrate that when employers clearly see where each dollar is going, they are more engaged in formulary decisions and benefit design. However, challenges remain. Not all PBMs are willing to give up spread pricing, and plan sponsors must be prepared to invest time in data analysis, ensuring that negotiated admin fees genuinely reflect the value of services provided.

Conclusion

As healthcare costs continue to rise, and namely specialty medications in the pharmacy realm, replacing spread pricing with a transparent admin fee model is an increasingly appealing solution. By eliminating hidden margins and realigning financial incentives, payers can gain more control over drug costs and deliver better value to their members. In an era where transparency is paramount, fee-based pharmacy benefit administration represents a sustainable, patient-centered approach that can be one support arm of the future of pharmacy services.

FAQ

1. What is spread pricing?

Spread pricing occurs when a PBM bills a health plan more for a prescription than what it pays the pharmacy, keeping the difference as profit.

2. How does an admin fee model work?

In an admin fee model, the PBM or pharmacy administrator charges a flat rate (e.g., per-member-per-month) instead of profiting from the difference between payer charges and pharmacy reimbursements.

3. Why is transparency important in pharmacy services?

Transparency ensures that payers know exactly how funds are used, helping them make informed decisions, reduce costs, and boost trust across the supply chain.

4. Can smaller plans benefit from a transparent admin fee?

Yes. Even smaller employers can benefit by avoiding hidden markups. By negotiating a fair, scalable fee, they still gain visibility into pharmacy spend and potential cost savings.

5. What are potential challenges in switching to an admin fee model?

Implementation requires analyzing plan data, negotiating new contracts, and ensuring that the chosen fee structure accurately reflects the plan’s clinical and operational needs. Not all PBMs are eager to abandon spread pricing practices, so selecting the right partner is crucial.